Introduction

In the fast-paced world of business, efficiency and accuracy are key to maintaining a competitive edge. One area where companies can significantly improve both is in their Accounts Payable (AP) processes. Traditionally, AP has been a labor-intensive and error-prone part of accounting, but with the advent of AP automation software, companies can streamline their workflows, reduce errors, and save substantial amounts of time and money. This article provides an in-depth look at AP automation software, covering its functionality, benefits, challenges, implementation considerations, and the top solutions available in the market.

What is AP Automation Software?

AP automation software is a technological solution designed to automate and enhance the processes involved in managing accounts payable. This includes capturing invoices, extracting and validating data, automating workflows, matching invoices with purchase orders, processing payments, and generating reports. By leveraging advanced technologies like artificial intelligence (AI), machine learning, and robotic process automation (RPA), AP automation software aims to reduce manual effort, improve accuracy, and increase the efficiency of the AP process.

How Does AP Automation Software Work?

AP automation software typically follows a series of steps to automate the AP process:

1. Invoice Capture

The software captures incoming invoices from various sources such as email, paper, PDF, and electronic data interchange (EDI). Optical Character Recognition (OCR) technology is often used to convert the data from these invoices into a digital format.

2. Data Extraction and Validation

Once the invoice data is captured, the software extracts key information such as invoice number, date, amount, and supplier details. This data is then validated against predefined criteria to ensure accuracy and completeness.

3. Workflow Automation

The validated invoice data is routed through an automated workflow that includes approval processes, audits, and checks. Authorized personnel receive notifications and can approve or reject invoices electronically.

4. Matching and Verification

The software matches invoice data with corresponding purchase orders and goods receipts. Any discrepancies are flagged for review and resolution.

5. Payment Processing

Upon successful approval and verification, the invoices are queued for payment. The software can automate the payment process, ensuring timely and accurate payments to suppliers.

6. Reporting and Analytics

AP automation software provides comprehensive reporting and analytics capabilities, enabling businesses to monitor their spending, analyze supplier performance, and gain insights into their financial health.

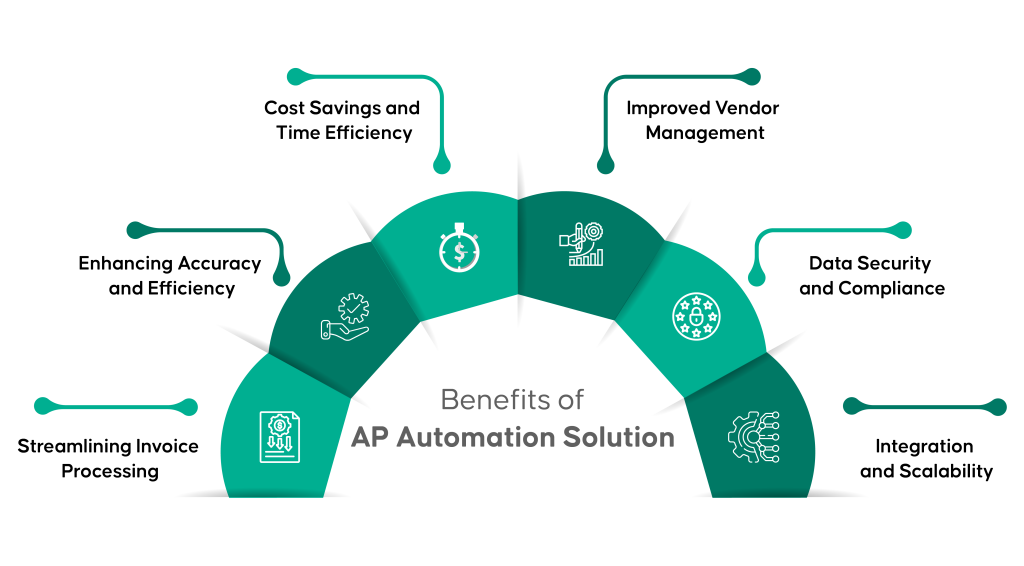

Benefits of AP Automation Software

1. Time and Cost Savings

Automating manual processes reduces the time required to process invoices, leading to significant cost savings. Companies can reallocate resources to more strategic activities, enhancing overall productivity.

2. Reduced Errors

Manual data entry is prone to errors. AP automation software minimizes these risks by automating data capture and validation, ensuring high levels of accuracy.

3. Enhanced Transparency and Control

The software provides real-time visibility into the AP process, allowing companies to track invoices at every stage and identify bottlenecks or irregularities promptly.

4. Improved Compliance

By automating audits and approval workflows, AP automation software helps ensure that all invoices comply with internal policies and regulatory requirements.

5. Better Supplier Relationships

Faster and more accurate payments improve supplier relationships, which can lead to better payment terms and discounts.

6. Scalability

AP automation software can easily scale with the growth of a business, handling increased invoice volumes without the need for additional resources.

Challenges and Considerations for Implementation

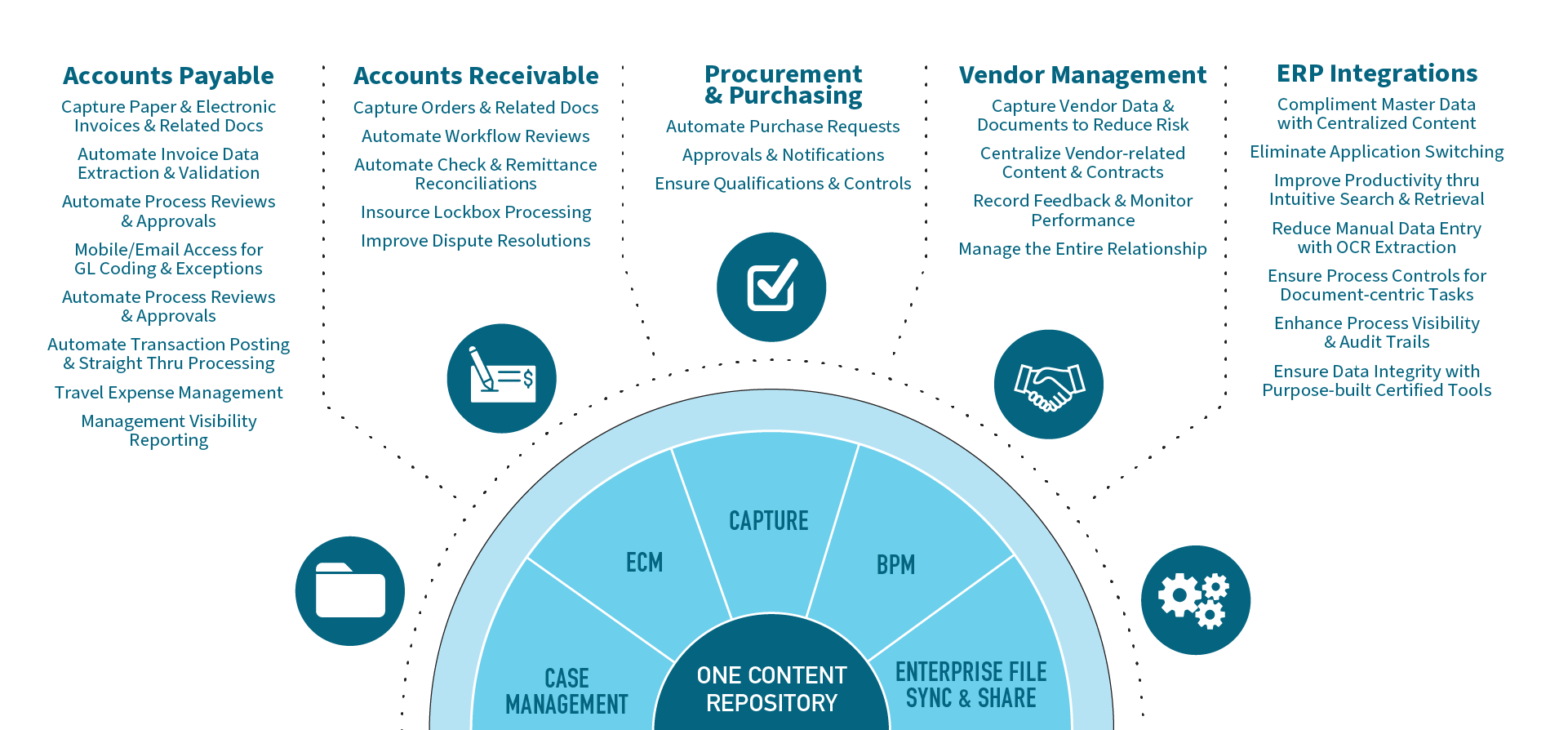

1. Integration with Existing Systems

One of the primary challenges in implementing AP automation software is integrating it with existing enterprise resource planning (ERP) systems and other financial software. Seamless integration is crucial for the success of the implementation.

2. Change Management

Introducing new technology requires changes to existing workflows and processes, which can face resistance from employees accustomed to traditional methods. Effective change management strategies are essential to ensure smooth adoption.

3. Data Security

As AP automation software handles sensitive financial data, ensuring the security of this data is paramount. Companies must ensure that the software adheres to stringent security protocols.

4. Implementation Costs

While the long-term savings can be substantial, the initial investment required for AP automation software can be significant. Companies need to carefully evaluate the costs and benefits.

5. Employee Training

Successful implementation requires proper training for employees to use the new system effectively. Investing in comprehensive training programs is necessary to maximize the benefits of the software.

Leading AP Automation Software Solutions

Several AP automation software solutions are recognized for their robust features and capabilities. Here are some of the top solutions available:

1. SAP Concur

SAP Concur is a comprehensive solution that automates travel, expense, and invoice management processes. It offers seamless integrations with various ERP systems and provides features such as automated workflows, real-time analytics, and mobile accessibility.

2. Tipalti

Tipalti is a global AP automation platform designed for mid-sized and large enterprises. It offers end-to-end automation from invoice processing to payment execution, with features like global payments, tax compliance, and fraud detection.

3. Coupa

Coupa is a leading spend management platform that includes AP automation features. It automates the entire invoice-to-pay process and provides extensive analytics and reporting capabilities to help companies manage their expenditures effectively.

4. Bill.com

Bill.com is a cloud-based AP automation solution suitable for small and medium-sized businesses. It offers easy integration, automated workflows, and mobile applications, making it a user-friendly option for companies looking to streamline their AP processes.

5. Basware

Basware provides a comprehensive solution for AP automation and spend management. It offers features such as e-invoicing, automated workflows, and detailed reporting, helping companies achieve greater efficiency and control over their AP processes.

Future Developments in AP Automation

The field of AP automation is continually evolving, driven by technological advancements and changing business needs. Here are some future developments that could shape the future of AP automation:

1. Artificial Intelligence and Machine Learning

AI and machine learning will continue to enhance AP automation by improving data extraction accuracy, identifying patterns, making predictions, and automating complex decision-making processes.

2. Blockchain Technology

Blockchain has the potential to make the invoice processing cycle more secure and transparent. By creating immutable transaction records, blockchain can ensure the integrity and traceability of invoices.

3. Robotic Process Automation (RPA)

RPA will play a significant role in further automating repetitive tasks in the AP process. Robots can perform tasks faster and more accurately than humans, leading to significant efficiency gains.

4. Advanced Analytics

The use of advanced analytics and big data can provide deeper insights into spending patterns and supplier relationships. This can lead to better strategic decision-making and cost savings.

5. Mobile Solutions

As the workforce becomes increasingly mobile, the availability of mobile AP automation solutions will become more important. These solutions allow employees to approve and manage invoices from anywhere, increasing flexibility and responsiveness.

Implementation Strategies for AP Automation Software

Successfully implementing AP automation software requires a strategic approach. Here are some key steps to ensure a smooth implementation:

1. Conduct a Needs Assessment

Before selecting a solution, conduct a thorough needs assessment to understand your company’s specific requirements. Identify pain points in your current AP process and determine the features and capabilities you need from an AP automation solution.

2. Select the Right Solution

Evaluate different AP automation software solutions based on their features, integration capabilities, scalability, and cost. Choose a solution that aligns with your business needs and goals.

3. Plan for Integration

Work closely with your IT team and the software provider to plan for integration with your existing systems. Ensure that the solution can seamlessly connect with your ERP and other financial systems.

4. Develop a Change Management Strategy

Implementing new technology requires change management. Communicate the benefits of AP automation to your employees and provide training to help them adapt to the new system. Address any concerns and provide support during the transition.

5. Test the System

Before full deployment, conduct thorough testing to identify and resolve any issues. This includes testing data capture, workflow automation, integrations, and payment processing.

6. Monitor and Optimize

After implementation, continuously monitor the performance of the AP automation software. Gather feedback from users and make necessary adjustments to optimize the system. Regularly review reports and analytics to identify areas for improvement.

Case Studies: Success Stories of AP Automation

1. Company A: Reducing Processing Time and Costs

Company A, a large manufacturing firm, implemented AP automation software to streamline its invoice processing. Before automation, the company struggled with manual data entry, lengthy approval cycles, and frequent errors. By automating the AP process, Company A reduced invoice processing time by 60% and achieved significant cost savings through early payment discounts and reduced labor costs. The software also provided real-time visibility into the AP process, enabling better financial management and decision-making.

2. Company B: Improving Compliance and Supplier Relationships

Company B, a global retail chain, faced challenges in maintaining compliance with diverse regulatory requirements across multiple regions. The implementation of AP automation software helped Company B standardize its invoice processing and ensure compliance with local regulations. The software’s automated workflows and approval processes reduced the risk of non-compliance and improved the accuracy of payments. As a result, Company B strengthened its relationships with suppliers, leading to better payment terms and improved supplier satisfaction.

3. Company C: Enhancing Scalability and Efficiency

Company C, a rapidly growing technology firm, needed a scalable solution to handle its increasing invoice volumes. AP automation software enabled Company C to process a higher volume of invoices without adding additional staff. The software’s advanced analytics provided insights into spending patterns, helping the company negotiate better contracts with suppliers. Company C also benefited from faster and more accurate financial reporting, supporting its growth objectives and improving overall operational efficiency.

AP Automation Software FAQ

What is AP Automation Software?

Q1: What is AP automation software?

AP automation software is a technological solution designed to automate and streamline the processes involved in managing accounts payable, such as invoice capture, data extraction, validation, workflow automation, matching invoices with purchase orders, payment processing, and reporting.

Q2: How does AP automation software work?

The software captures invoices from various sources, extracts key data, validates it, and routes it through automated workflows for approval and verification. It matches invoices with purchase orders, processes payments, and provides comprehensive reporting and analytics.

Benefits of AP Automation Software

Q3: What are the primary benefits of using AP automation software?

Key benefits include time and cost savings, reduced errors, enhanced transparency and control, improved compliance, better supplier relationships, and scalability to handle increased invoice volumes.

Q4: How does AP automation software save time and money?

The software automates manual tasks such as data entry, invoice matching, and approval workflows, significantly reducing the time and labor required for these processes. This leads to cost savings through reduced labor costs and the ability to take advantage of early payment discounts.

Q5: How does AP automation software improve accuracy?

By automating data capture and validation, AP automation software minimizes human errors associated with manual data entry, ensuring higher accuracy in invoice processing.

Q6: Can AP automation software help with compliance?

Yes, the software automates audits and approval workflows, ensuring that all invoices comply with internal policies and regulatory requirements, reducing the risk of non-compliance.

Implementation and Integration

Q7: How do I choose the right AP automation software for my business?

Conduct a thorough needs assessment to understand your specific requirements. Evaluate different solutions based on features, integration capabilities, scalability, cost, and user reviews. Choose a solution that aligns with your business goals.

Q8: What are the challenges of implementing AP automation software?

Challenges include integrating with existing systems, managing changes in workflows, ensuring data security, managing implementation costs, and providing adequate training for employees.

Q9: How long does it take to implement AP automation software?

The implementation timeline can vary depending on the complexity of your existing systems and the scope of the solution. It can take anywhere from a few weeks to several months.

Q10: What kind of training is required for using AP automation software?

Comprehensive training programs are necessary to ensure employees understand how to use the software effectively. Training typically covers system navigation, data entry, workflow management, and reporting.

Features and Functionality

Q11: What features should I look for in AP automation software?

Key features to look for include invoice capture, data extraction, validation, automated workflows, invoice matching, payment processing, reporting, and analytics.

Q12: Can AP automation software handle invoices in different formats?

Yes, most AP automation software solutions can capture invoices from various sources, including paper, PDF, email, and electronic data interchange (EDI).

Q13: How does AP automation software handle invoice matching?

The software automatically matches invoice data with corresponding purchase orders and goods receipts, flagging any discrepancies for review and resolution.

Q14: Does AP automation software integrate with ERP systems?

Many AP automation solutions offer seamless integration with popular ERP systems, ensuring smooth data flow between your AP processes and other financial systems.

Security and Compliance

Q15: How secure is AP automation software?

AP automation software is designed with robust security features to protect sensitive financial data. Look for solutions that offer encryption, secure data storage, and compliance with industry standards.

Q16: Can AP automation software help with tax compliance?

Yes, some AP automation solutions include features for managing tax compliance, such as automatic tax calculations, VAT handling, and generating tax-compliant reports.

Advanced Technologies

Q17: How does artificial intelligence (AI) enhance AP automation software?

AI can improve data extraction accuracy, identify patterns, make predictions, and automate complex decision-making processes, further optimizing the AP workflow.

Q18: What role does machine learning play in AP automation?

Machine learning algorithms can continuously learn from data, improving the software’s ability to recognize and process invoices accurately over time.

Q19: How can blockchain technology be used in AP automation?

Blockchain can enhance the security and transparency of the invoice processing cycle by creating immutable transaction records, ensuring the integrity and traceability of invoices.

Q20: What is Robotic Process Automation (RPA), and how is it used in AP automation?

RPA uses software robots to automate repetitive tasks, such as data entry and invoice matching. This leads to faster and more accurate processing, reducing the need for human intervention.

Future Developments

Q21: What are the future trends in AP automation?

Future trends include greater integration of AI and machine learning, the use of blockchain technology for enhanced security, increased adoption of RPA, advanced analytics for deeper insights, and mobile solutions for greater flexibility.

Q22: How will mobile solutions impact AP automation?

Mobile AP automation solutions allow employees to approve and manage invoices from anywhere, increasing flexibility and responsiveness, which is especially important in a mobile workforce.

Vendor-Specific Questions

Q23: What are some of the leading AP automation software solutions available?

Some leading solutions include SAP Concur, Tipalti, Coupa, Bill.com, and Basware. Each offers a range of features and capabilities tailored to different business needs.

Q24: How do SAP Concur and Coupa differ in terms of AP automation?

SAP Concur focuses on travel, expense, and invoice management with robust integrations and real-time analytics. Coupa is a broader spend management platform that includes comprehensive AP automation features and extensive analytics.

Q25: Is there AP automation software specifically designed for small businesses?

Yes, solutions like Bill.com are designed for small and medium-sized businesses, offering user-friendly interfaces, easy integration, and mobile applications to simplify AP processes.

Practical Use and ROI

Q26: How quickly can I expect to see a return on investment (ROI) with AP automation software?

ROI can vary based on the initial investment and the scale of implementation. However, many companies see significant time and cost savings within the first year, leading to a quick ROI.

Q27: Can AP automation software help with cash flow management?

Yes, by providing real-time visibility into outstanding invoices and payment schedules, AP automation software helps companies manage cash flow more effectively and make informed financial decisions.

Q28: How does AP automation software affect supplier relationships?

Faster and more accurate payments improve supplier relationships, leading to better payment terms, discounts, and overall supplier satisfaction.

Troubleshooting and Support

Q29: What kind of support is typically offered by AP automation software vendors?

Most vendors offer a range of support options, including online documentation, training resources, customer service hotlines, and dedicated account managers to assist with any issues or questions.

Q30: How do I handle issues or errors in the AP automation process?

Most AP automation software includes error detection and resolution features. If issues arise, you can refer to the vendor’s support resources or contact their customer service for assistance.